Bitcoin is moving sideways, posting drab price action, forcing participation to taper. But amid this consolidation and even fear of more losses, one analyst has shared data suggesting that long-term holders are accumulating at spot rates.

Are We Back To 2021? Bitcoin Long-Term Holders Accumulating

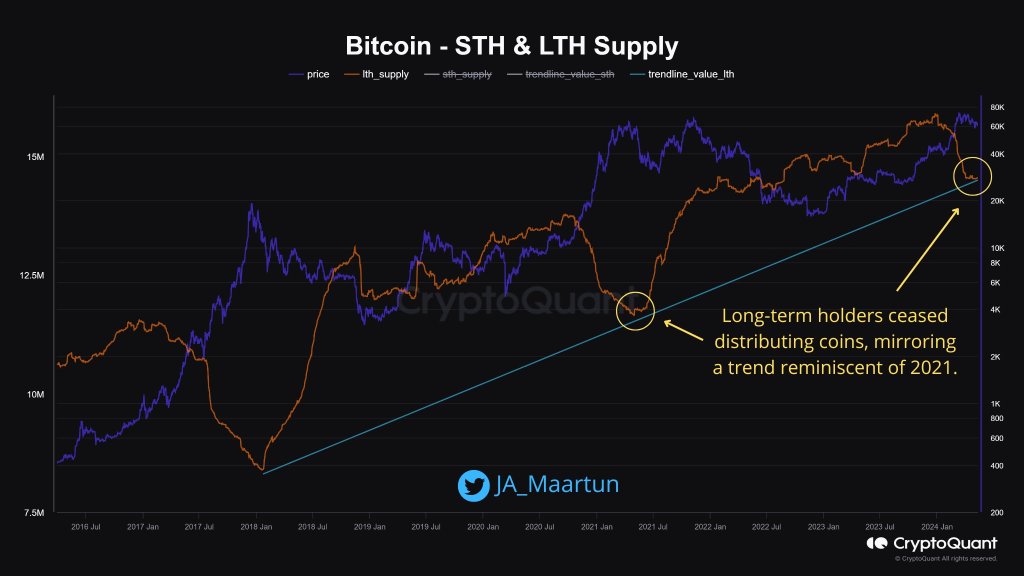

In a post on X, the analyst noted that this re-accumulating pace is picking up momentum, mirroring a welcomed trend that preceded the impressive 2021 bull run.

Therefore, if long-term holders, or HODLers, accumulate, the probability of BTC rallying in the sessions ahead is elevated. Thus far, BTC has been trending above $60,000, up 10% from the May 2024 lows.

For clarity, the data shared by the analyst uses Unspent Transaction Outputs (UTXOs) to classify long-term and short-term holders. Analyzing the age of UTXOs makes it easier to gauge the behavior of different investor groups.

Usually, UTXOs older than 155 days have “diamond hands” or long-term holders. Meanwhile, those who hold BTC for less than 155 days are short-term holders or often classified as “weak” hands.

They are usually traders or speculators interested in riding on price volatility, like in the first half of Q1 2024.

When long-term holders stopped distributing BTC in 2021, prices rose sharply. By November 2021, the coin had peaked at around $70,000, lifting prices by nearly 1,500% from 2020 lows. It is unclear if BTC is ready for another 15X surge from spot rates, a move that would propel it to over $700,000.

BTC Has Strong Support At $60,000, Analyst Urges Patience

While the on-chain data paints a bullish picture, some analysts advocate caution. Taking to X, one analyst notes that Bitcoin has strong support at around the psychological $60,000 mark. The coin could stabilize if bulls soak in selling pressure and reject attempts for lower lows.

However, if prices dump below $60,000, triggered by a news event, BTC may fall to as low as the $52,000 to $55,000 zone.

Despite the potential for short-term volatility, the analyst encourages investors to maintain a long-term perspective. Accumulating Bitcoin at these levels and exercising patience could be a winning strategy, the analyst says.

This preview would be especially true now that on-chain data shows that long-term holders are accumulating.

Before then, traders should watch price action. The coin is moving sideways, finding rejection at $66,000. Even though prices are lower, the last day’s series of higher highs is encouraging and might spark demand.

Feature image from DALLE, chart from TradingView

Read More: Bitcoin Long-Term Holders Accumulating Like In 2021: Is BTC Ready For A 15X?

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.