The crypto market stands on the brink of a transformative year in 2024. Indeed, the industry is poised for significant changes with new technologies emerging.

These advancements promise to enhance the functionality and utility of digital currencies and address some of the most pressing challenges facing the market today.

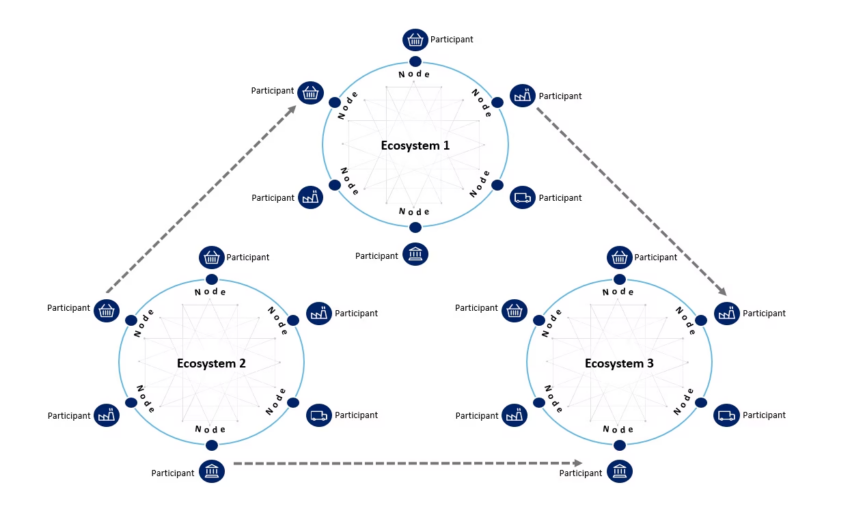

The Promise of Interoperability

A pivotal development in blockchain technology is the advancement of interoperability protocols. Kadan Stadelmann, Chief Technology Officer at Komodo Blockchain, told BeInCrypto about the critical compatibility between blockchains.

“Blockchain interoperability empowers distinct blockchain networks to communicate, share data, and collaborate. It is the glue that binds together various blockchain ecosystems as well as their respective cryptocurrencies, non-fungible tokens, and decentralized applications,” Stadelmann said.

This breakthrough enables different blockchain ecosystems to connect seamlessly, facilitating a more cohesive and efficient crypto environment. As interoperability increases, so does the decentralization of the entire blockchain sector, ushering in a trustless user experience where reliance on centralized exchanges diminishes.

Interoperability binds various cryptocurrencies, NFTs, and decentralized applications together, heralding the cross-chain decentralized exchanges (DEXes) era. These platforms allow for trading assets across disparate blockchains and the movement of assets from one blockchain to another.

“Blockchain solutions to date have been formed around existing smaller ecosystems for relatively simple use cases. To realize blockchain’s promising results for global supply chains that intersect with multiple ecosystems and utilize multiple blockchain platforms, interoperability is critical,” analysts at Deloitte wrote.

Read more: How to Launch Cross-Chain DApps: A Guide to Interoperability

Therefore, this innovation aims to address the longstanding issue of liquidity fragmentation in the crypto market, providing a more streamlined and user-friendly trading experience.

“Developing or leveraging cross-chain solutions can pioneer dApps that seamlessly operate across multiple blockchains. This not only diversifies their user base but also allows them to tap into various existing ecosystems, presenting unparalleled opportunities for innovation, growth, and the development of novel decentralized solutions,” Stadelmann added.

A number of initiatives are leading the charge towards a more interconnected blockchain environment, each introducing innovative methods and technologies to advance interoperability.

Bridging Blockchains Together

The growth of decentralized finance (DeFi) is a testament to interoperability and blockchain technology’s revolutionary potential. According to Stadelmann, smart contracts and DEXes have become the backbone of DeFi. They offer peer-to-peer (P2P) lending, borrowing, and trading without the need for traditional financial intermediaries.

Essentially, DeFi democratizes finance, lowering barriers to entry and fostering financial inclusivity and transparency, challenging the foundation of traditional banking and finance.

“DEXes offer a way to trade crypto assets via peer-to-peer networks, automated market maker (AMM) liquidity pools, or hybrid forms that combine both P2P and AMM tech. Lending and borrowing protocols facilitate P2P crypto lending while decentralized oracles bridge the gap between off-chain and on-chain data. Collectively, these solutions empower users with unprecedented control over their assets,” Stadelmann affirmed.

Read more: A Complete Guide to P2P Decentralized Exchanges (DEXs)

As interoperability increases, the entire blockchain sector becomes more and more decentralized. Interoperability is crucial because it creates a more trustless user experience without third-party intermediaries such as centralized exchanges.

For instance, Polkadot utilizes an innovative parachain structure that allows multiple blockchains to interlink and interact within a unified network. This method facilitates interoperability and consolidates security and data sharing among the interconnected chains. Therefore, it marks a significant step toward a cohesive blockchain infrastructure.

“Moreover, cross-chain DEXes, such as the one built into Komodo Wallet, allow users to trade assets across separate blockchains (i.e. BTC and ETH) or bridge/move assets from one blockchain to another (i.e. convert BEP-20 USDT to PLG-20 USDT),” Stadelmann affirmed.

Cosmos, on the other hand, employs its Inter-Blockchain Communication (IBC) protocol. It enables a direct and trustless transmission of messages and value between autonomous chains. The concept of an “internet of blockchains” presented by Cosmos emphasizes the critical role of interoperability in realizing the decentralized and scalable network necessary for Web3’s success.

Chainlink has developed the Cross-Chain Interoperability Protocol (CCIP) to facilitate a standardized, secure, and smooth exchange of data and commands across diverse blockchains. Chainlink’s initiative underlines the essential need for secure and dependable data interchange to support the future of blockchain’s interoperable capabilities.

“Banks now understand that, without a way to interoperate with their counterparties’ chains and with public chains, they won’t be able to be successful in whatever assets they create. Interoperability is now a hard requirement [also for blockchains],” Chainlink Co-Founder Sergey Nazarov said.

Enhacing Privacy and Security

Integrating zero-knowledge technology into blockchain networks is another significant stride toward enhancing privacy and security. Zero-knowledge proofs allow for the validation of transactions without revealing sensitive information, addressing privacy concerns associated with public blockchains.

Ramani Ramachandran, Chief Executive Officer at Router Protocol, told BeInCrypto that zero-knowledge proofs contribute to creating secure and private transactions, essential in applications where data sensitivity is paramount. Therefore, such an important cryptographic innovation is crucial for use cases demanding confidentiality, making it a cornerstone for future blockchain applications.

“Adopting zero-knowledge proofs is a significant step towards achieving a balance between transparency and privacy in blockchain networks, making them more suitable for a wider range of applications, including those requiring strict data protection,” Ramachandran explained.

Likewise, Vitalik Buterin, the Co-Founder of Ethereum, believes in the use of privacy pools as a mechanism to enhance confidentiality in financial dealings. This approach utilizes zero-knowledge proofs to enable individuals to certify their separation from any funds associated with unlawful activities.

“The next logical advancement in the quest for increased cryptographic privacy involved the introduction of general purpose zero-knowledge proofs, as used in blockchains like Zcash and on-chain smart contract systems like Tornado Cash. Such systems allow the anonymity set of each transaction to potentially equal the entire set of all previous transactions,” Buterin wrote.

Buterin highlighted that solutions based on zero-knowledge proofs are anticipated to see substantial growth over the next year. This surge is expected as global regulations shift and individuals increasingly prioritize safeguarding their privacy.

Read more: On-Chain and Off-Chain Privacy in Web3: Differences Explained

Still, Stadelmann emphasized that the industry remains vulnerable to other threats and “new obstacles that might not exist today.” These include quantum computing, advancements in artificial intelligence, and environmental concerns, which pose significant hurdles. But Ramachandran also stressed the risks of regulatory uncertainty.

“Regulation is almost the only thing I see inhibiting the growth and adoption of blockchain technology. The tech is here, the developers and interest are here, we just do not have a set rulebook. This makes potential users, entrepreneurs, and investors skeptical and wary of getting involved, seeing it as too much risk,” Ramachandran concluded.

Staying informed and engaged with the latest advancements and regulatory developments is essential. Especially, for overcoming these obstacles and capitalizing on the transformative potential of blockchain technology. Stadelmann adviced entrepreneurs to be involved in the blockchain community, participate in regulatory dialogues, and support technological innovations to proactively address any challenges.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read More: This New Tech Will Transform Crypto in 2024

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.