Sales of non-fungible tokens (NFTs) took a hit this past week, dropping by 11.16% compared to the previous week.

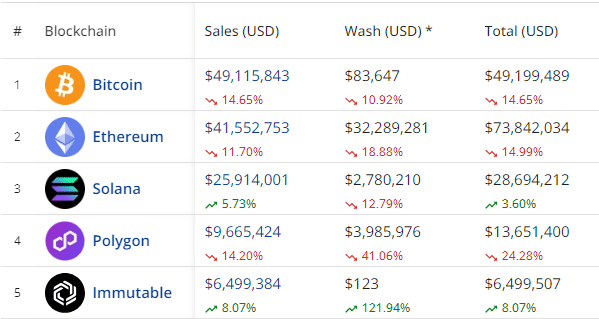

Data from cryptoslam.io shows that this week’s total sales reached $144.33 million, with Bitcoin-based NFTs contributing more than $49 million to this total. However, despite the impressive figures, the sales of digital collectibles on Bitcoin (BTC) fell by 14.65%.

NFTs on Ethereum (ETH) generated $41.55 million in sales, also down by 11.7% from the prior week. Solana (SOL) NFTs, ranking third in sales, earned nearly $26 million, experiencing a modest increase of 5.73% this week.

Per cryptoslam, the Polygon (MATIC) network registered the fourth-highest NFT sales volume over the previous seven days, raking in $9.66 million.

However, the figure was a 14.2% dip compared to what NFT traders on the blockchain had sold at the same point a week ago.

Wrapping up the top five blockchains by sales volume was Immutable (IMX), which recorded a respectable $6.49 million in sales.

The amount marked a more than 8% uptick, making Immutable the only other network among the top five whose sales volume improved across the timeframe.

NFT collections

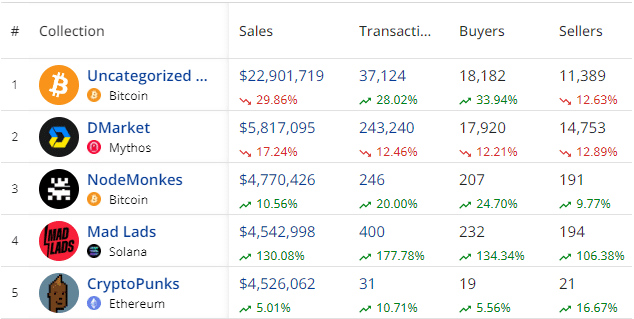

This week’s top seller was the Uncategorized Ordinals from the Bitcoin blockchain, bringing in $22.9 million in sales. Sales for the collectibles declined by nearly 30% compared to the previous week.

Mythos’ Dmarket collection claimed the second spot, earning $5.817 million, which marked a 17.24% decrease.

On the flip side, the Nodemonkes collection from the Bitcoin blockchain saw a 10.56% increase in sales, reaching $4.77 million from 246 transactions.

Other notable collections this week included Mad Lads, CryptoPunks, Degods, and Solana Monkey Business. The Mad Lads collection, housed on Solana, registered the biggest improvement in terms of sales volume, with the $4.5 million that exchanged hands representing a 130% increase from last week.

Among individual NFTs, the most significant and expensive sale over the week was Cryptopunk #3619, which fetched $627,991.

Furthermore, Solana’s Boogle #064 changed ownership for $192,124, while Mushroom #95 from the BTC network earned $135,096.

The consistent decline in sales week after week indicates a cautious sentiment among collectors.

According to data from Cryptoslam, there were slightly more than 145,000 buyers active in the market over the week — an 86% drop from the week prior.

Read More: NFT sales dip, Bitcoin takes hit but dominates market share

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.