MicroStrategy (MSTR) has upsized its convertible debt offering to $700 million from $600 million to buy more bitcoin (BTC).

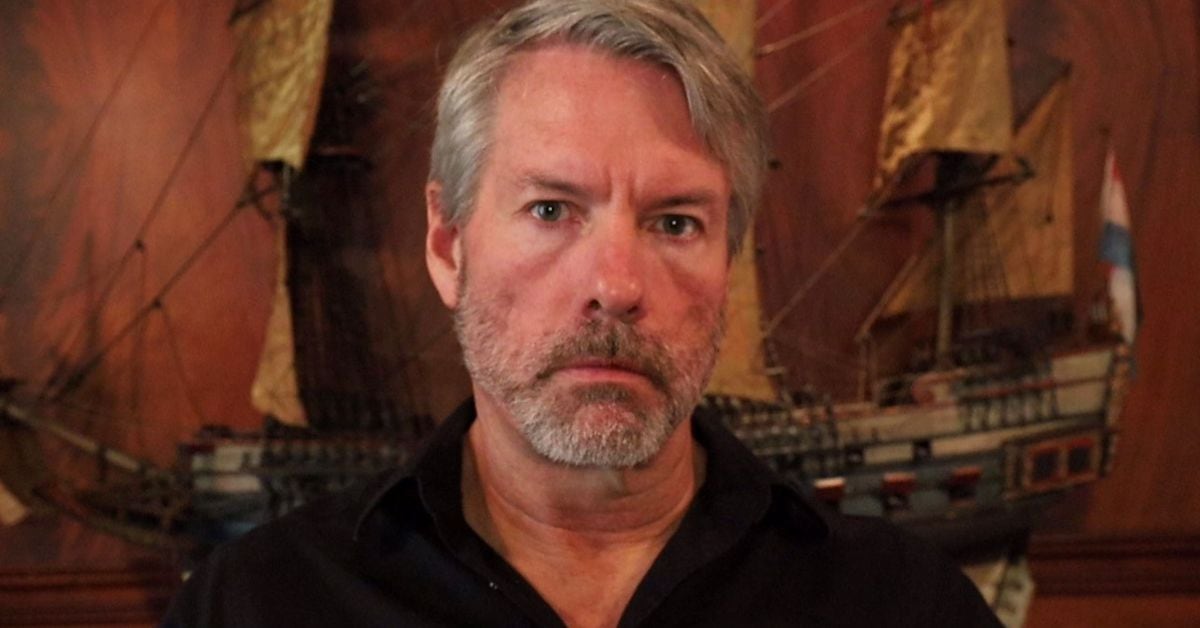

The Tysons Corner, Virginia-based firm, founded by staunch bitcoin advocate Michael Saylor, is now looking to raise $700 million through the sale of convertible seniors notes at an interest rate of 0.625% per annum, MicroStrategy said in a statement on Wednesday.

The firm also announced the pricing of its convertible debt. The conversion rate for the notes will initially be equivalent to $1,497.68 per share, representing a 42.5% premium compared to Tuesday’s closing price of $1,051.01.

MicroStrategy’s stockpile of around 193,000 BTC – worth around $13 billion at the current price – is the largest of any publicly traded companies, having been a relentless bitcoin accumulator for several years.

The shares of MicroStrategy were trading around $1,227.02 at the time of writing, up nearly 17% on the day. The stock fell a similar amount on Tuesday as bitcoin price dipped below $64,000 after attaining a new all-time high above $69,000.

Read More: MicroStrategy Upsizes Convertible Debt Offering to $700M to Buy Even More Bitcoin

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.