1 min – Around 2 mins mins to read

Key Points:

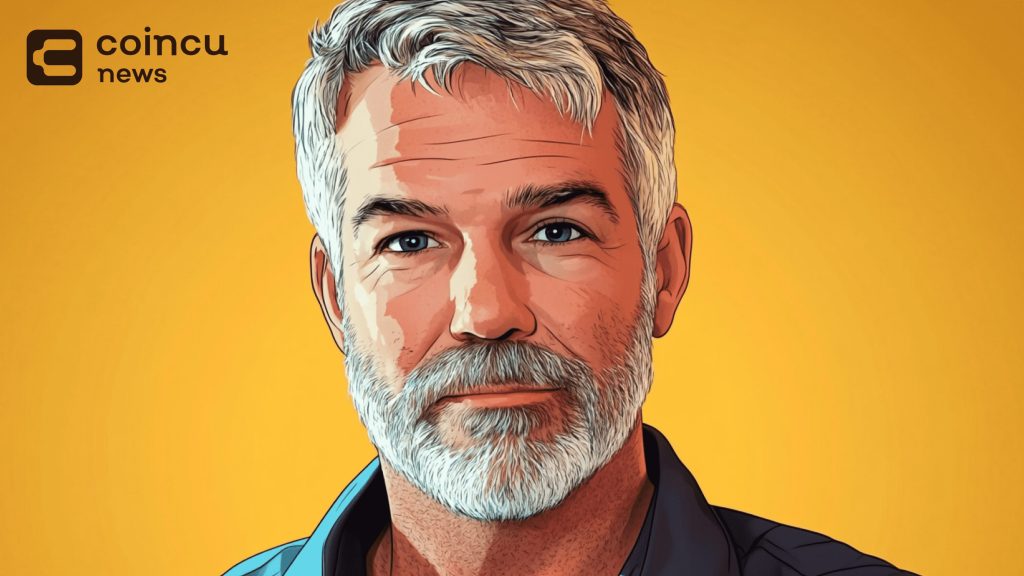

- MicroStrategy founder Michael Saylor faced backlash after suggesting Bitcoin holders trust “too big to fail” banks instead of using self-custody.

- Prominent figures criticized Saylor’s comments, accusing him of undermining Bitcoin’s role as a decentralized currency.

MicroStrategy founder Michael Saylor became a target of the Bitcoin community with his suggestion that users should allow large financial institutions to keep custody of their Bitcoin rather than keeping them in self-custody.

Read more: MicroStrategy Bitcoin Investment Will Be Boosted With $2 Billion Share Offering Plan

MicroStrategy founder Michael Saylor Now Changed His Stance

His comments represent a change of heart from his earlier self-custody advocate comments when the FTX implosion occurred in November 2022. During that time, MicroStrategy founder Michael Saylor replied that self-custody of Bitcoin ensures that powerful custodial organizations cannot corrupt the system.

In an interview with financial reporter Madison Reidy on October 21, Saylor insisted that holders would be better off leaving their assets in the care of “too big to fail” banks, underlining at the time that would provide a safety net in case of losses. He also referred to any concerns over government confiscation as “unnecessary.”

Saylor Faces Backlash Over Bitcoin Custody Shift

Saylor’s about-face on self-custody has set off a firestorm of criticism among Bitcoiners. Ethereum co-founder Vitalik Buterin publicly dissented from Saylor’s comments, employing the descriptor “batshit insane.”

Sina, founder of Bitcoin custody firm 21st Capital, declared that Saylor was destroying the use case for Bitcoin as a currency, saying, “Saylor is on a mission to relegate Bitcoin into an investment pet rock and halt its usage as a currency.”

As would be expected, Saylor remains upbeat about Bitcoin’s long-term value despite the pushback. Having assumed the role of CEO, he led MicroStrategy to its current status as the largest corporate holder of Bitcoin, with over 252,220 BTC in its portfolio.

He previously went as far as to predict that Bitcoin could rise to $13 million per coin by 2045, further solidifying his optimism about Bitcoin’s future, though many took him to task over the comments regarding custodianship.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read More: MicroStrategy Founder Michael Saylor Criticized For Controversial Proposal – BitRss –

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. coinzoop.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.