Fidelity Digital Assets, a leading issuer of spot Bitcoin ETFs in the US, has revised its medium-term outlook on Bitcoin from positive to neutral.

This shift, detailed in their Q1 2024 Signals Report released on April 22, stems from several concerning trends in Bitcoin’s market performance.

Why Fidelity Changed Its Bitcoin Medium-Term Stance?

The Fidelity Wise Origin Bitcoin Fund (FBTC) has seen impressive growth, amassing over $8 billion in inflows. It stands as the second-fastest growing Bitcoin ETF since its launch. Despite this success, recent analyses point to a significant shift in Bitcoin’s valuation outlook.

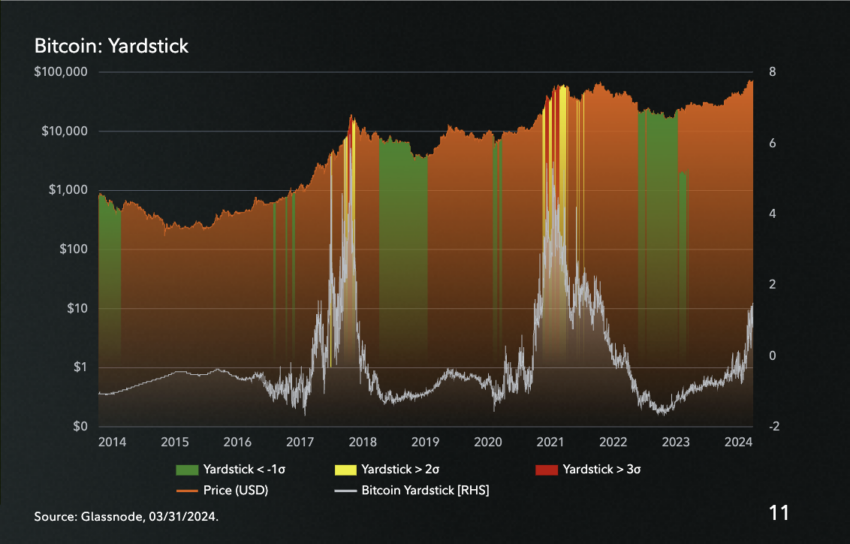

The Bitcoin Yardstick, or Hashrate Yardstick, serves as a key metric, similar to the Price-to-Earnings (PE) Ratio used in traditional stock markets. This ratio compares Bitcoin’s total market cap to its hash rate, which measures the computational energy securing the network.

“The idea is that the lower the ratio, the “cheaper” Bitcoin looks, just as a lower PE ratio can be interpreted as a “cheap” or undervalued stock,” Fidelity explained.

According to the report, there was not a single day in Q1 when Bitcoin was deemed “cheap.” The cryptocurrency fluctuated between zero and two standard deviations from the mean for half of the quarter. Importantly, values above two deviations typically signal an overvaluation relative to the network’s energy output.

Read more: Bitcoin Price Prediction 2024/2025/2030

The neutral outlook is further supported by increased sell pressure from long-term holders and a high percentage of profitable addresses, which could encourage selling.

“We believe on-chain indicators are now clearly above the lows or extreme bottoms previously observed. However, we are nowhere near the historical extreme highs,” Chris Kuiper, Fidelity Digital Assets’ Director of Research said.

Nonetheless, Fidelity’s outlook is not uniformly cautious. The firm maintains a positive view in the short term, after the profit-taking activities at the end of the first quarter.

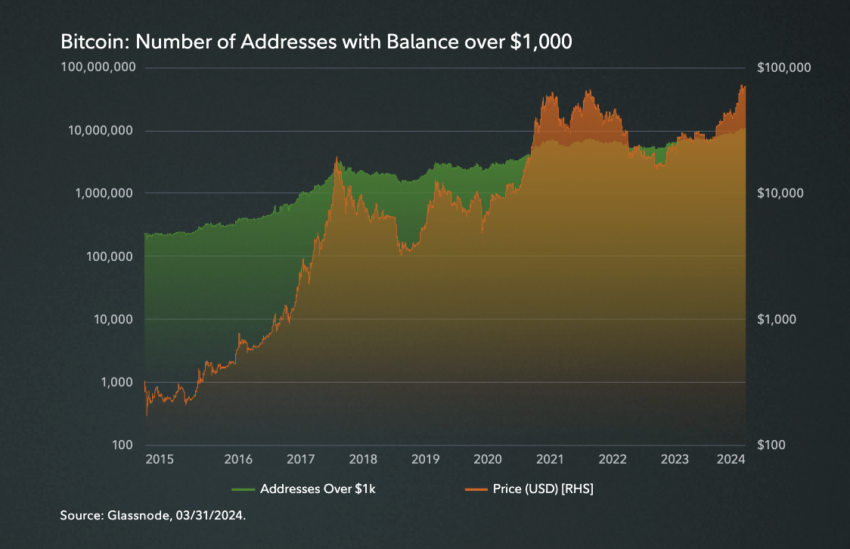

Moreover, on-chain data indicates ongoing accumulation by smaller investors. The number of addresses holding at least $1,000 worth of Bitcoin increased by 20% since the beginning of the year, reaching new all-time highs.

“This shows a continued growth of small addresses accumulating and saving Bitcoin, even with rising prices. This may also be representative of a growing distribution of Bitcoin and its adoption among the “average” person,” Fidelity notes.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Also exchange balances have declined as more investors opt for self-custody, which could reduce selling pressure.

After reaching an all-time high of $73,777 on March 14, Bitcoin experienced a sharp correction, falling to $60,775 within a week. Since then, it has oscillated between $60,000 and $71,800. As of writing, it is trading around $66,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read More: Fidelity Warns Against Rising Selling Pressure, Updates Bitcoin Outlook to ‘Neutral’

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.