Ethereum, the world’s second largest blockchain, should switch over to a completely new version this year, one that will change basically everything about how it operates. The Ethereum Foundation calls the new version “The Merge,” but many others refer to it as “Ethereum 2.0.”

Why it matters: For blockchain critics, it will massively reduce the energy consumption of Ethereum (maybe by 99%). For ether holders, it will reduce the emissions of that coin, which should improve price appreciation.

- For onlookers: It’s sort of like changing the engine in a jumbo jet from gas powered to electric, without landing — it could be a real mess.

- That said, to say that the developers have been cautious about deploying it would be an understatement roughly on par with: “Jupiter is a little larger than other planets in its solar system.”

Big picture: Because blockchains have no leader, they need a way for all users to agree that transactions on the network are valid, that is: to reach consensus.

- The coming update will move Ethereum’s consensus method from a proof-of-work system (like Bitcoin) to a proof-of-stake system (like most other new blockchains).

- Either methold discourages bad actors by making it too expensive to operate maliciously.

- Proof-of-work requires miners, the entities that verify all transactions are legit, to do a ton of computational work (which requires lots of electricity). They earn fresh coins for this work.

- All that electricity has caused a lot of ire to be directed at blockchains.

In proof-of-stake, instead of volts, validators put a large amount of ETH at risk. If they behave maliciously or incompetently, the network can take that ETH.

- Again, making it expensive to cheat, but using different means.

- A validator will stake a minimum of 32 ether (~$38,200) to run a node, but people can also participate by delegating ether to professional node operators (most people will just do that).

- As of this writing, with the new version still on its way, 403,814 validators have staked a total of 13.6 million ethers.

Be smart: If you hold ethers or Ethereum tokens or NFTs on exchanges or in a personal wallet, you don’t need to do anything.

- “Nothing happens from a user perspective. The last block was proof-of-work and the next block is proof-of-stake,” Tim Beiko, who coordinates Ethereum’s developers, tells Axios in an interview.

When? No one will say for sure and it has been delayed many times, but everyone still believes it will happen this year. Testnet deployments have mostly gone well, though they did find some new bugs.

- When the timing is announced, it will be pegged to a very arcane moment called “total difficulty.” When that’s announced, folks should be able to estimate within a day or two of when it will change over.

Users support the switch

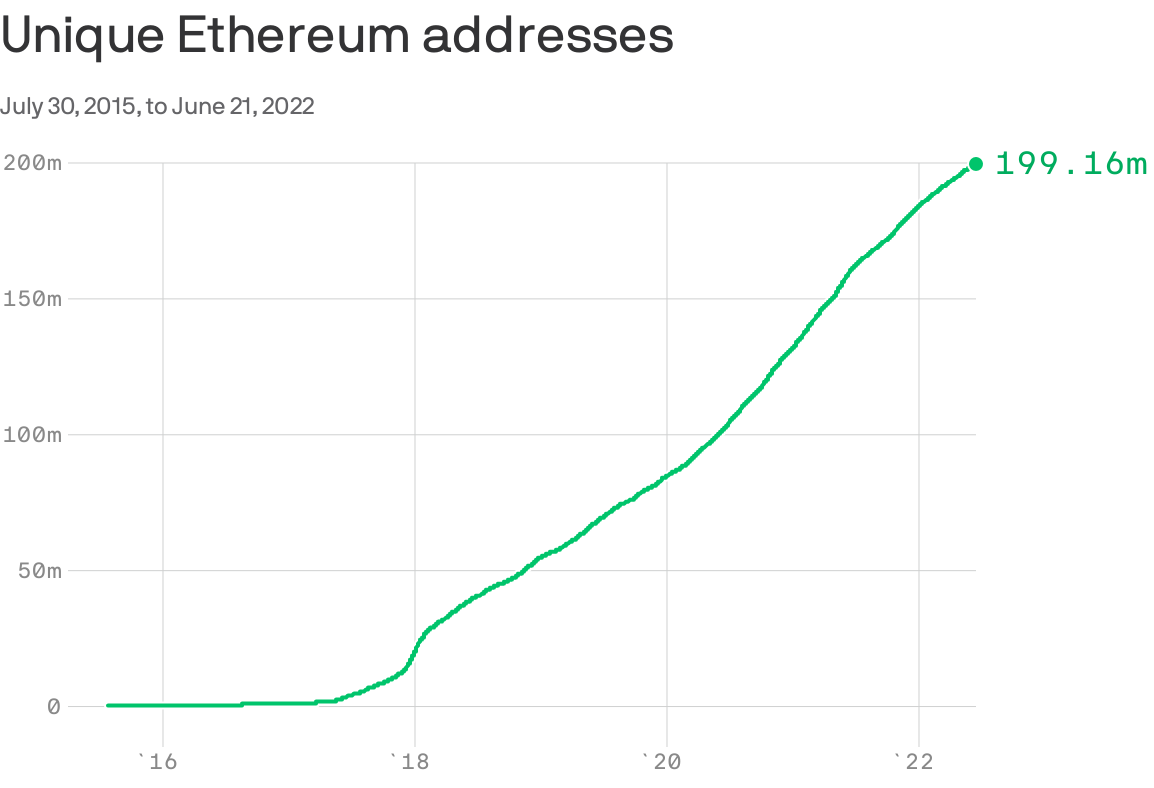

Ethereum has become very popular, and active Ethereum users are by and large supportive of the switch.

- There’s a lot of users on Ethereum, but every wallet is not a unique user.

- Still, lots more wallets almost certainly means significantly more actual users.

One pain point that all users behind those 199 million+ addresses agree on, however: Gas fees.

- Context: Ethereum is a full computer that runs as a blockchain. Because every validator runs all the computations users demand, users have to pay for that processing work in ETH (which they call “gas”).

- It can be quite pricey, to the tune of hundreds of dollars for one slightly complicated transaction when demand is high.

Reality check: This will not change when Ethereum switches to proof-of-stake.

- Beiko explained, “The limitations for the throughput are completely independent of the consensus algorithm that we use.”

Flashback: The chain won’t get much faster, either, even though the next phase of the rollout had been a plan to create “shards.” Shards are basically independent blockchains that all check in with the main one.

- That plan has changed, somewhat. A bunch of layer-2 solutions have come online, which is basically the same thing as shards, so Ethereum has embraced that instead, according to Beiko.

- There will still likely be some sharding, but probably a less ambitious model, and it won’t change gas prices on Ethereum proper.

Gains

So if gas fees aren’t getting cheaper and processing won’t get any faster, why are people who already like Ethereum excited about v2?

- Simple: Gains.

- Everyone believes that ethers will become much more valuable in a world where the supply increases more slowly.

Why it matters: Blockchains pay validators by emitting new coins regularly and awarding them to people who secure the blockchain. Holders of blockchain coins want validators to be paid, but just enough to make it worthwhile to keep securing the network.

What they’re saying: Angel investor and ETH believer Eric Conner explained on Twitter how much Ethereum users are paying miners right now, writing, “Ethereum block times are about 13s which translates to ~4,850,000 ETH produced a year ($8.6bn, ~4% inflation) *just* to pay for security of the network.”

- That inflation was then cut in half by an update that destroys some of the Ethereum spent on gas each block.

In the weeds: Once proof-of-stake begins, inflation will depend on how much Ethereum is staked, Beiko explained. At current staking levels, though, issuance would drop from almost 5 million ETH to more like 600,000 ETH, annually.

- And burning the ETH at each block will continue. In fact, many believe so much will be burned that the supply of ether will shrink every day.

Ergo: If Ethereum keeps getting used by more and more people, ether should become more dear.

- Couple that with a decreasing supply, and holding ether, Ethereum believers contend, looks like a very smart investment.

The bottom line: If everything goes right, basic day-to-day users of the leading smart contract blockchain should barely be able to tell that anything has changed.

Read More: Ethereum’s new version is still on track for 2022

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.