US businesses are increasingly implementing blockchain-based tools and products. Explore the current state of corporate crypto adoption in finance, tech, and payments.

Cryptoassets are steadily making inroads into the real world, proving they are far more than mere speculation. The blockchain’s potential to drive economic and technological advancement is increasingly recognized by businesses, as evidenced by the growing number of practical use cases being implemented.

Enterprise adoption of blockchain-based solutions is a crucial metric for evaluating the entire crypto space, and now is a good time for collecting data. With the previous hypes of ICOs, DeFi, and NFTs having somewhat subsided and the new hype of asset tokenization just beginning to gather steam, it’s a great opportunity to assess which crypto use cases are currently dominating the business landscape.

The recently published Coinbase’s report “State of crypto: The Fortune 500 moving on-chain” gives a comprehensive overview of the current dynamics. It uses insight from on-chain analytics firm The Block, different surveys conducted by Coinbase itself, and other open-source data, all in order to collect and analyze US companies’ activity related to crypto and blockchain.

Here are the key takeaways.

The number of crypto initiatives growing

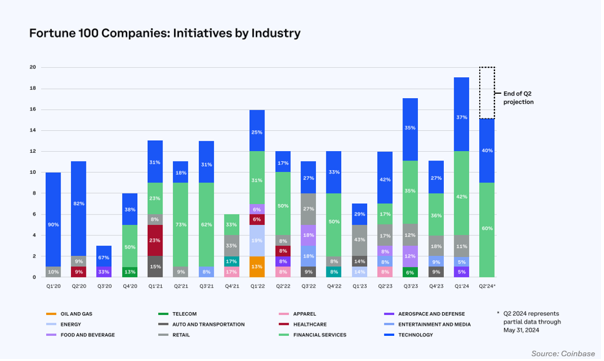

The number of cryptocurrency, blockchain, or web3 initiatives underway by the Fortune 100 companies hit a record high in Q1 24. The lion’s share of these initiatives comes from the financial and tech sectors, with retail, entertainment, and food and beverages also present.

Among the Fortune 500 executives, 56% say their companies are working on blockchain-related projects. They report an average budget of $9.5 million for 2024 and most of them say their companies will maintain or increase it over the next two years.

Crypto considerations have also influenced hiring trends. Half of Fortune 500 executives recognize the potential benefits of crypto and tokenization, highlighting the need for a robust talent pipeline to support ongoing innovation. Meanwhile, 53% of small businesses are likely to seek job applicants with crypto knowledge for future finance, legal, or IT/tech roles.

Blockchain for Finance

In the financial sector, the adoption of blockchain is particularly noteworthy, with crypto spot ETFs and asset tokenization being the two most prominent use cases.

Spot Bitcoin ETFs have become a popular investment vehicle, with assets under management exceeding $63 billion. The SEC’s approval of spot Ether ETFs further expands access to crypto investments.

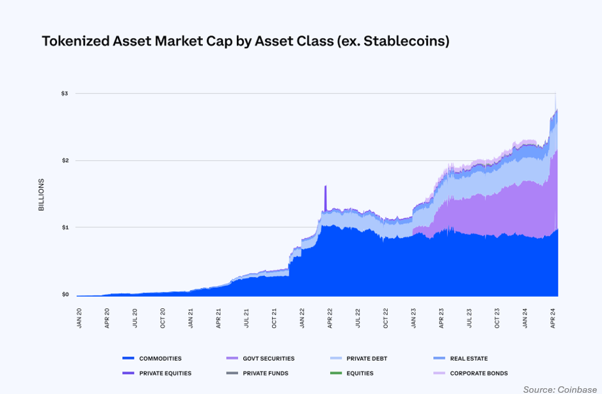

Tokenized assets (also called real-world assets, or RWA) represent another significant development, reaching almost $3 billion.

High interest rates have fueled demand for tokenized US Treasury products, which have surged over 1,000% since early 2023, now reaching $1.29 billion. So far, this is the only asset class that prominent US TradFi companies, such as BlackRock and Franklin Templeton, are tokenizing. The second-biggest RWAs are commodities, private debt, and real estate, but this list is far from being exhaustive. Just yesterday, Infineo and Prov Labs announced another first in the RWA sector by tokenizing life insurance policies.

Blockchain for Tech

The tech sector is embracing blockchain in various innovative ways. Major tech companies are incorporating blockchain into their services to enhance capabilities and support infrastructure development. Thus, Google has introduced features to make blockchain information searchable and is acting as a validator for new blockchains. Microsoft is testing blockchain networks for asset tokenization, while IBM partners with Casper Labs, the developer of the eponymous AI-focused blockchain.

Blockchain for Payments

Blockchains are borderless by nature and are increasingly valued for their role in facilitating payments and settlements. Stablecoins are the most popular assets here, and they are becoming an integral part of the payment landscape for businesses of all types and sizes. In 2023, the annual settlement volume of stablecoins reached $10 trillion, which is over 10 times the amount of global remittance. Companies like PayPal and Stripe are enhancing stablecoin usability for merchants and facilitating cross-border transfers.

Both big and small businesses are recognizing blockchain’s potential to make their payments cheaper and faster. Payments are currently the #1 crypto use case for Fortune 500 and Fortune 100, while 68% of small businesses believe crypto can address their financial pain points. The report highlights that US merchants paid an estimated $126 billion in credit card transaction fees in 2022. Using stablecoins could significantly reduce these costs, eventually bringing crypto to Main Street.

The integration of blockchain into big and small businesses is transforming the corporate landscape, driving increased blockchain activity and boosting demand for cryptocurrencies. A win-win scenario that propels both technology and business forward.

Read More: Crypto Adoption: How US Businesses are Embracing Blockchain

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. coinzoop.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.