The crypto market embraced some semblance of stability on Sunday following massive, devastating, and crippling liquidations from Friday. Bitcoin price tumbled to as low as $61,000 amid the market’s reaction to geopolitical tensions in the Middle East late last week.

Despite the immediate liquidations investors suffered, especially on leverage positions that affected the entire crypto market, small and large-cap altcoins included, Bitcoin had bounced above $64,000 by Sunday evening.

A fresh bullish outlook started forming on Monday bolstered by news of the Hong Kong Securities and Futures Commission (SFC) approving spot Bitcoin and Ethereum Securities.

Can Bitcoin Price Rally To $73k ATH As Hong Kong ETF Operators Announce Approval?

Several Bitcoin ETF operators including the China Asset Management, Bosera Capital, and others claimed on Monday that their applications had been greenlighted to operate in the leading Asian financial hub.

The announcement according to CoinDesk was published on WeChat, China’s official social media messaging app. Despite the claims, the SFC was yet to make an official communication regarding the approvals, prompting some posts to be deleted.

Based on insight from 10x Research, a Singapore-based analytics platform, the Hong Kong SFC is likely not the ultimate jurisdiction to approve of spot Bitcoin and Ethereum ETF approvals.

If the approval in Hong Kong is confirmed, it could “be an additional demand driver for Bitcoin from various countries that could approve Spot ETFs, namely Australia, Japan, Korea, and the UK,” the research firm said.

Demand for Bitcoin due to the ETF approval is anticipated to go up significantly, mirroring the uptick in price in Q1 this year to a new all-time of $73,803, data by CoinGecko shows.

Bitcoin Halving Beckons

The popular Bitcoin halving event, which is used to reduce the supply of new coins joining the active supply, is expected to occur between April 17 and 21 according to most calculators such as NiceHash.

Bitcoin halving engraved in the network code takes place after every 210,000 blocks or approximately after four years. To keep Bitcoin a scarce digital asset, the rewards miners receive for securing the network are cut in half. For instance, the initial reward was 50 BTC per block but after this halving, it will go down to only 3.125 BTC.

Halving has come to be referred to as a market mover with prices rallying following the event. However, what investors look forward to is the bull cycle that follows the halving due to the impact of the supply crunch coupled with increasing demand.

Bitcoin price has shown the tendency to rally several months after halving, for instance, following the previous halving in 2020 Bitcoin price surged to a record high of $69,000 in November 2021.

If history repeats itself, Bitcoin is expected to rally above $100 in 2024 and continue the uptrend in 2025. The uptick in BTC will also trigger price increases across the market with major altcoins hitting unprecedented levels.

BTC had recovered above $66,000 and trading at $60100 during US business hours on Monday, reflecting the growing interest in the crypto market following the massacre over the weekend.

The approval of Bitcoin and Ethereum ETFs in Hong Kong also reflects positively on the market, with investors willing to buy the dips anticipating a major breakout ahead of the halving.

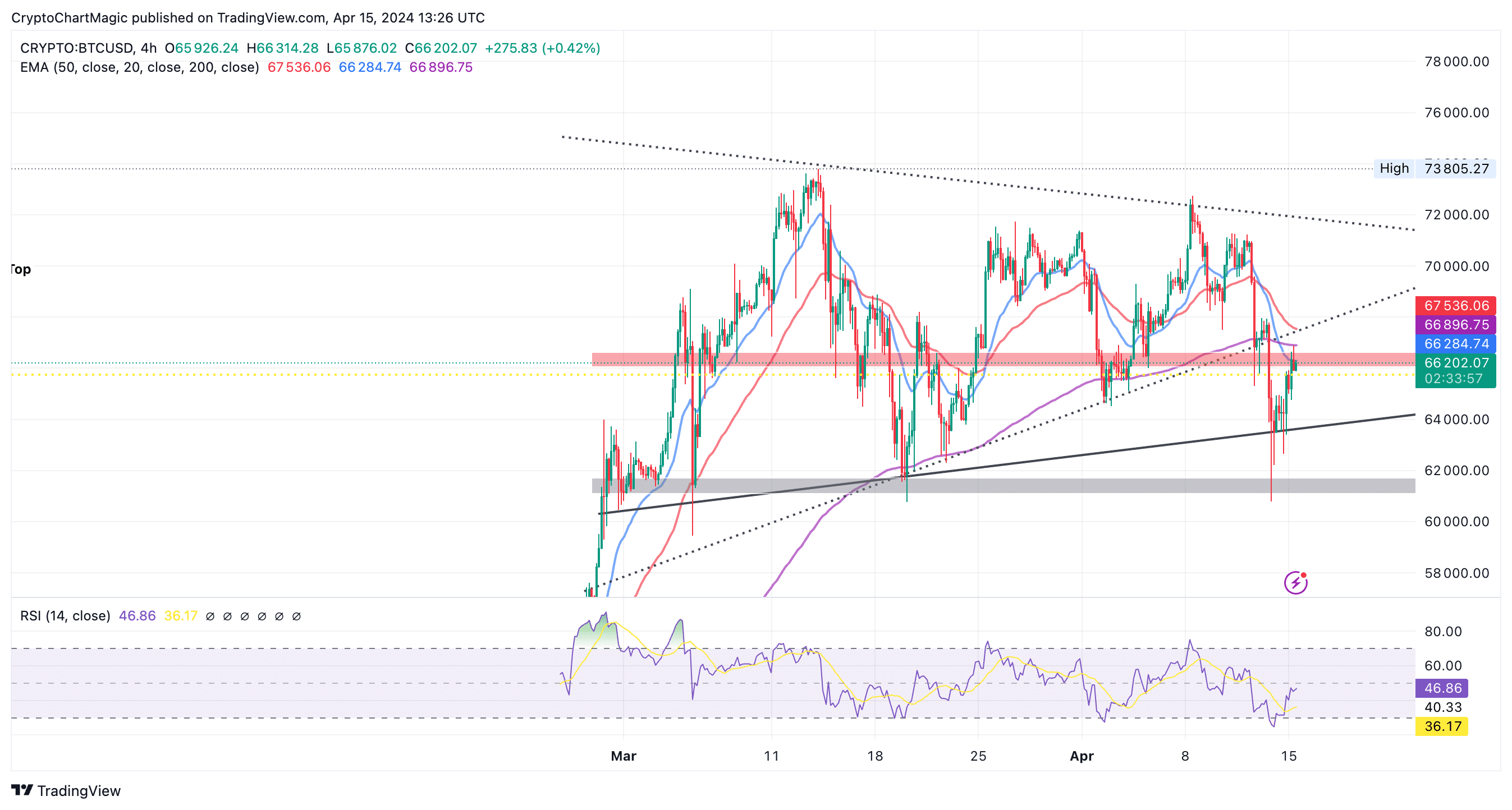

It is essential to look for a break above the red resistance band, which if broken will make possible the continuation of the uptrend toward $70,000 and eventually the ATH.

The recovery Relative Strength Index (RSI) at 46 from 25 on Sunday reinforces the new bullish. Movement in the neutral area targeting the overbought region will further reinforce the uptrend.

Related Articles

Read More: Bitcoin Price Today: Will Bitcoin Breach March 14 $73K ATH Before Halving?

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.