Bitcoin (BTC-USD) miner CleanSpark’s (NASDAQ:CLSK) shares took a nosedive, plummeting 10% in after-hours trading yesterday after the company announced an expanded $800 million stock offering. The offering is significantly higher than the previously agreed $500 million deal with H.C. Wainwright & Co.

CleanSpark Decision Hits Other Miners

Initially, CleanSpark’s $500 million at-the-market (ATM) offering seemed like a calculated move to bolster its position within the competitive mining landscape. However, the upsized $800 million offering has stirred concerns over share dilution, with a projected 19% dilution rate based on the company’s $4.2 billion market cap.

While common among public companies seeking capital influx, this strategy has notably rattled investor confidence.

This event has impacted CleanSpark and cast a shadow over the broader Bitcoin mining sector, prompting comparisons with similar ATM agreements by rivals Riot Platforms (NASDAQ:RIOT) and Marathon Digital Holdings (NASDAQ:MARA).

Despite the short-term downside in price action, Bitcoin’s halving event may be a boon for CleanSpark. CLSK boasts a competitive edge with the lowest production cost per Bitcoin while doubling its hash rate with recent acquisitions.

Levels to Watch This Weekend

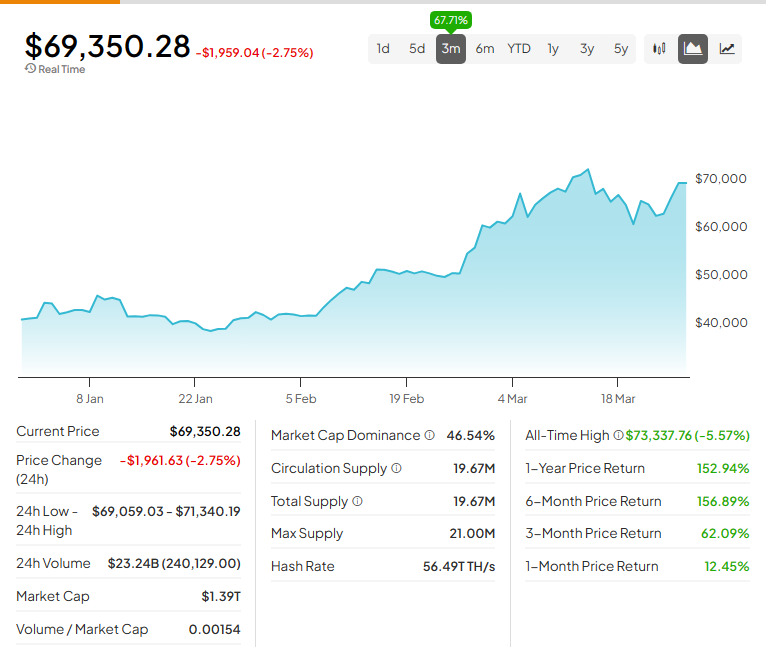

From a technical analysis perspective, Bitcoin remains exceptionally bullish on a long-term timeframe. However, there are some concerns that its performance may turn bearish in the near term.

Since hitting a new all-time high of $73,734 on March 14, Bitcoin’s price action has been mixed. Between March 14 and March 21, BTC dove -17.5% to the $60,700 value area (a drop of -$13,000). Since then, bulls have spent the last nine days grinding higher back to the $70,000 value area, but the bulls have been either unwilling or unable to move higher. Near-term resistance is at the $71,450 level, while support sits at $60,750.

Don’t let crypto give you a run for your money. Track coin prices here

Read More: Bitcoin Miner CleanSpark (NASDAQ:CLSK) Dives 10% after Stock Offering – TipRanks.com

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.