Bitcoin is rushing towards the next halving in big steps and is now even on the hunt for its own record again. Because on Tuesday night, BTC got another good boost of 9 percent plus and is now trading at $56,000 or just under 52,000 euros.

And that is quite remarkable. Because the last time Bitcoin was traded at such a price on international crypto exchanges was in November 2021. That was the month when BTC reached its previous peak of $68,789 ($63,394). As of today, the most important cryptocurrency is only around 18 percent away from this.

One of the drivers of the development is Michael Saylor’s company MicroStrategy, which bought another 3,000 BTC for around $155 million on Tuesday night. The company is the largest known holder of Bitcoin and owns 193,000 BTC – worth more than $6 billion.

Bitcoin Halving is expected in April

Boosted earlier this year by a series of new Bitcoin spot ETFs for big money, Bitcoin is now hurtling towards the next halving. This will most likely take place in mid-April 2024. After that, the amount of new Bitcoins that miners receive for their computing power will be halved. In the past, this has led to sharp price increases several times (at intervals of several months).

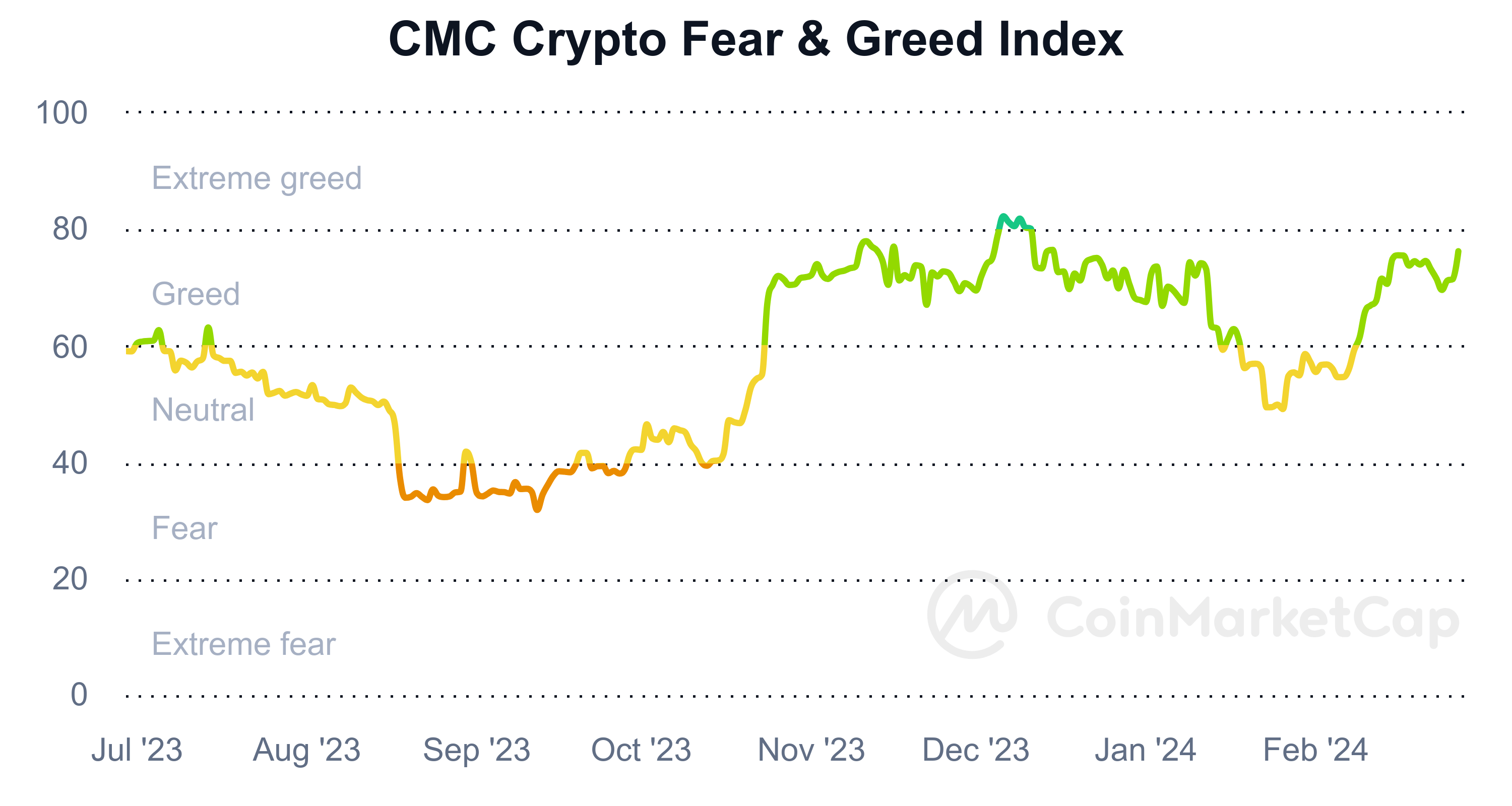

It is quite possible that the approaching halving will once again create a good mood in the crypto market. The Fear & Greed Index, which measures the mood in the crypto sector, is currently clearly green. This means: Investors on crypto exchanges are in a buying mood because they expect further price increases. This is what it currently looks like:

No hype, but steadily increasing demand

However, there are differences from November 2021, when Bitcoin reached its all-time high. Because the broad masses who invest in the asset are still missing. “Bitcoin has also surpassed $50,000 before. But this time it’s different. There is no rush in the markets, no overheated coins and no social media hype. We see the result of a constantly increasing demand for digital assets. The increasing demand in turn results from a combination of steadily increasing investments from private investors, smart money from institutional US investors which has been pushing onto the market since the approval of Bitcoin Spot ETFs, progressive regulation that is important for the market, and growing trust in crypto assets and improved access to crypto assets,” said Bitpanda CEO Eric Demuth in an analysis.

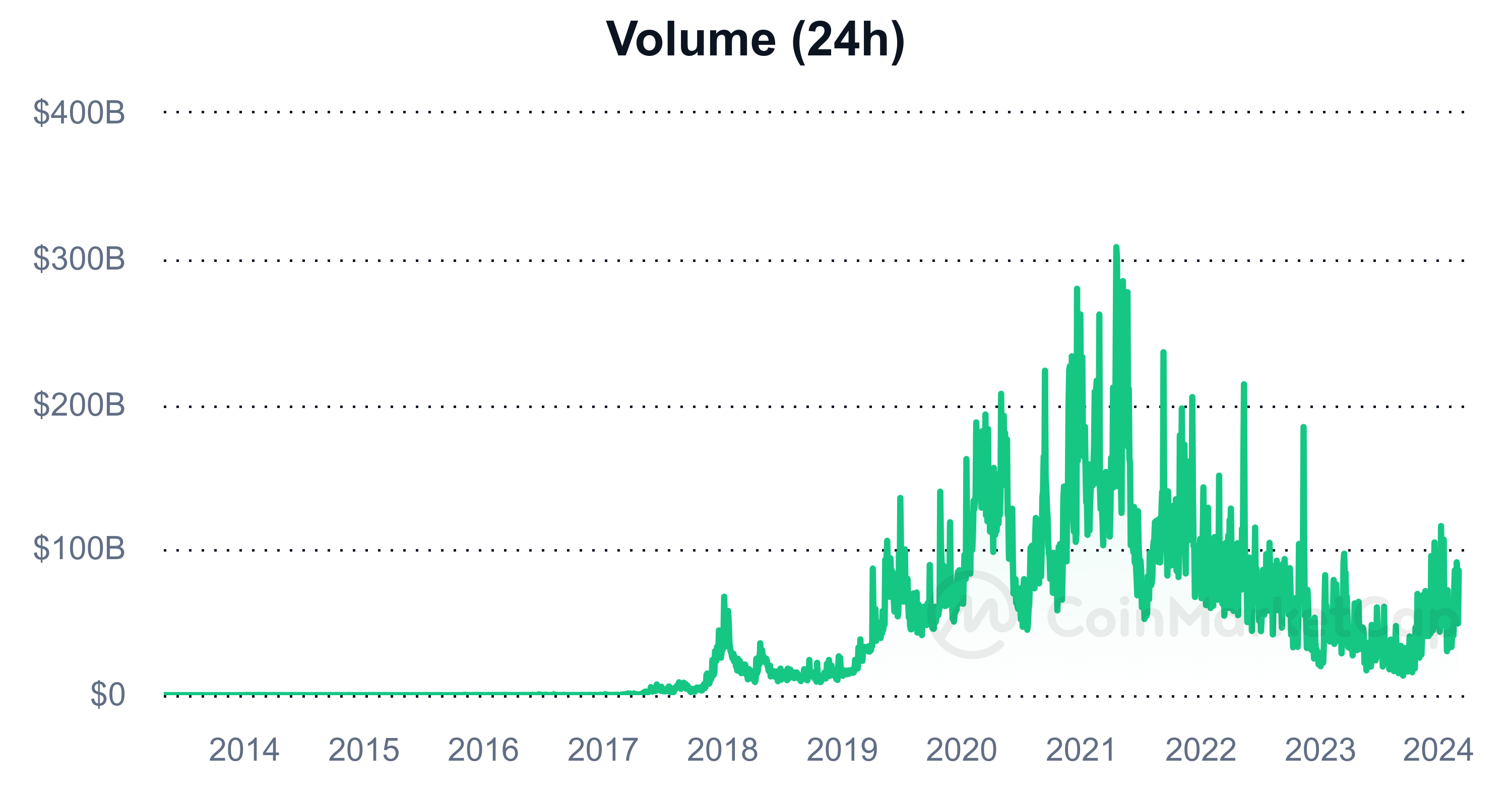

And further: “Recovering economies, expected interest rate cuts and the Bitcoin halving provide a positive outlook for this year. So 2024 will be a good year for crypto – and it’s just begun.” In this chart you can clearly see that the daily trading volume around November 2021 was much higher than today:

Read More: Bitcoin at $56,000 – and only 18% away from its all-time high

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.