Stablecoin supply is changing. After a mixed month, BTC analysts are now watching USDT and USDC and how it will impact Bitcoin prices – here’s what you need to know.

Crypto and stablecoins are never in stasis. Bitcoin can be a leader in one category but depends on the performance of other sectors and even the broader financial markets to succeed.

The launch of stablecoins, with USDT being the first, was a game-changer. Finally, the community would have a “stable” asset that also serves as a conduit into the sphere.

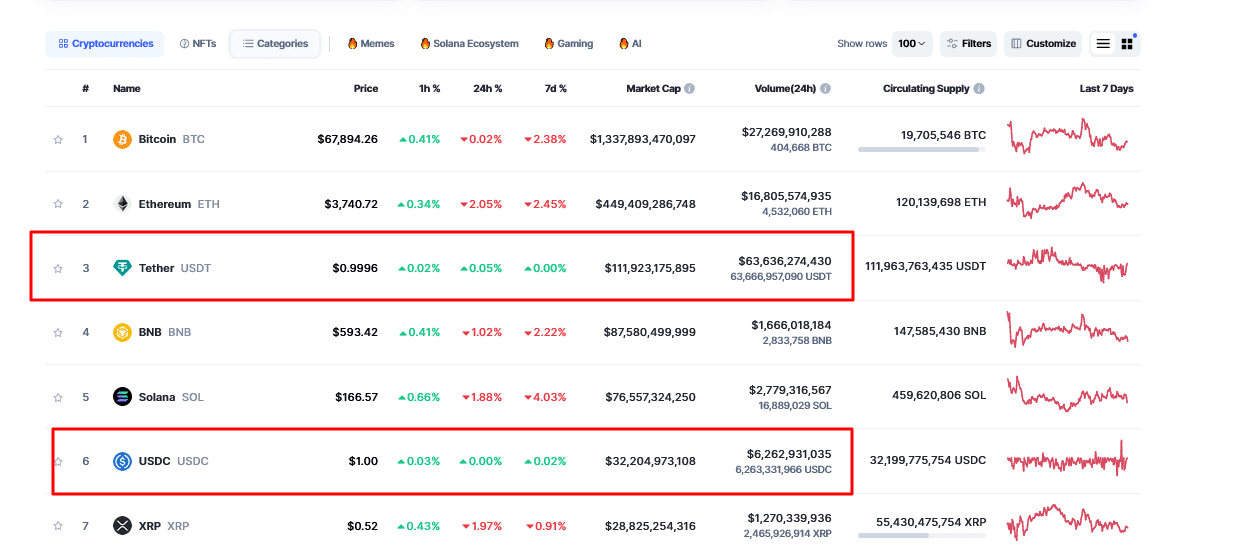

The world’s largest stablecoin, USDT, tracks the greenback and commands a market cap of over $111 billion, cementing its place as the third largest crypto after Bitcoin and Ethereum.

You might think the $111 billion is a product of market volatility. Now. This figure is the value of tokens minted by crypto participants. Every USDT in circulation is “theoretically” backed by multiple assets, mostly United States Treasuries.

Impressively, the number has been rising even after the collapse of UST, an algorithmic stablecoin by Terra Luna.

Nonetheless, things are fast changing. There have been notable shifts in the stablecoin scene, significantly impacting Bitcoin, especially after a drab month in May that was mainly mixed.

Stablecoins Supply At A 2-Year High – Here’s Why

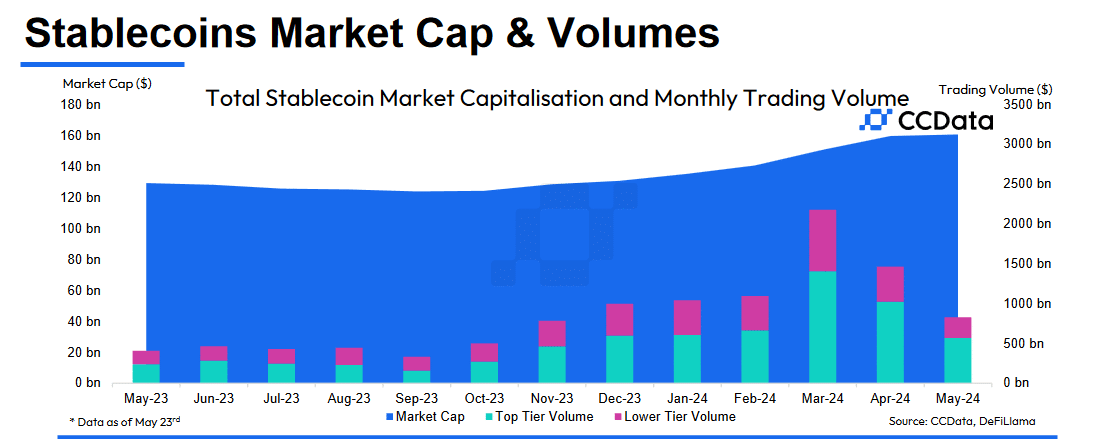

According to a report compiled by CCData, the market capitalization of stablecoins has been growing steadily in the last eight months, rising to a two-year high.

As of May 29, the total stablecoin market cap rose to $161 billion. Despite this impressive growth, their dominance fell to 6.07%, down roughly 7% from May.

(CCData)

CCData analysts said the decline was due to crypto assets, especially Ethereum and its token, rising in anticipation of the United States SEC approving a spot ETH ETF.

Meanwhile, USDT and its main competitor, USDC–which has been rising steadily in the past six months–have been expanding.

During this time, Bitcoin, Ethereum, Solana, and top altcoins, including meme coins, have been pumping.

Analysts have picked out a direct correlation between USDT and USDC minting and the performance of Bitcoin.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 1,000,000,000 #USDT (1,000,359,999 USD) minted at Tether Treasuryhttps://t.co/i6scFY73OO

— Whale Alert (@whale_alert) May 21, 2024

Whenever billions of USDT or USDC are minted, BTC often rises or steadies in subsequent sessions.

This correlation cements that stablecoins are used as conduits, allowing investors to quickly shuttle in and out of their positions without necessarily converting to fiat.

Therefore, it is only fitting to conclude that rising stablecoins positively impact Bitcoin and top crypto assets, boosting liquidity and improving the overall market sentiment.

The Key Question: Will Bitcoin Rally In June?

Interestingly, though, since decentralized networks like Base, Solana, and even Ethereum support USDC and USDT, widespread use, analysts say, makes BTC even more appealing during periods of uncertainty.

The USDC de-pegging in early March 2023 was a prime example. USDC de-pegged only for BTC and ETH to shoot higher as investors poured into the more liquid and “stable” coins.

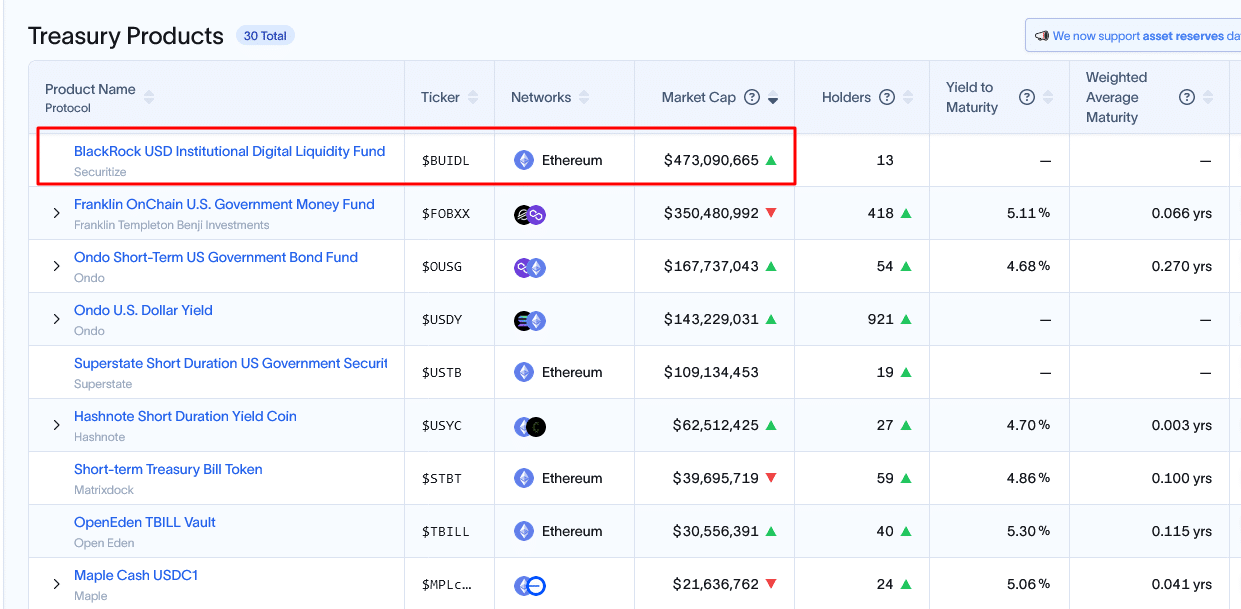

Beyond use in on-chain transactions, the adoption of USDC–which is audited regularly–by institutions is another endorsement. This would draw more capital to leading coins, benefiting Bitcoin.

BlackRock’s BUIDL shares can be readily swapped for USDC. Thus far, BUIDL, tokenized on Ethereum, is the largest of its kind for tokenizing United States Treasuries.

No one knows how Bitcoin will perform in June 2024. However, if history guides, rising stablecoin supply, improving market sentiment, increasing institutional adoption, and the expectation of a post-halving bull run will only drive prices higher.

(BTCUSDT)

For now, Bitcoin is ending strongly in May, up roughly 20%. Still, buyers need to break $72,000 for the uptrend to continue.

EXPLORE: RNDR Price Analysis: As Render Token Primes In Chart, is Other Coin Next to Explode?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Read More: What do Stablecoin Supply Dynamics Mean for Bitcoin In June 2024?

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. coinzoop.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.