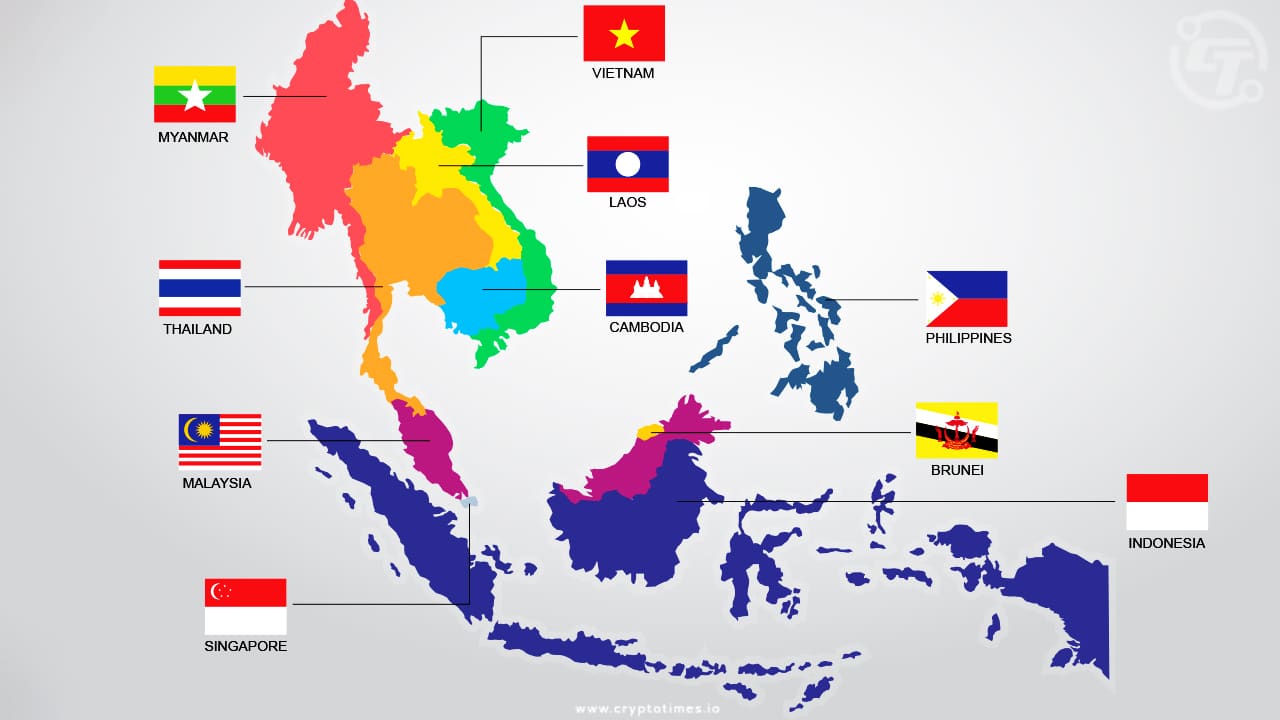

During the last few years, the technology industry has grown rapidly in the South-East Asia region, with an increasing number of unicorn companies.

Two of the fastest-growing areas within the technology industry in SE Asia have been the markets for artificial intelligence and cryptocurrencies.

According to data provided by Statista, the artificial intelligence market in the region will reach a value of US$6.72 billion this year.

What are the most used business models in the SEA technology market?

There are various business models used by technology companies within the region; some of the most used are:

Sustainable Ventures

The business model of companies that are focused within the sustainability business segment has been growing in recent years, known as the Green Tech market.

E-commerce Platforms

E-commerce platforms have quickly positioned themselves as one of the fastest-growing business models in the SEA region, with rapidly growing demand in countries like Thailand, Singapore, and Vietnam.

Payment Systems

Fintechs are usually characterized by providing various payment alternatives to the payment systems offered by traditional financial companies, some examples of which can be payments using QR technology, or virtual wallets like Grab Pay, and Lineman, among others.

Lending

There is a large population within the SEA region who cannot access credit due to poor credit scoring; fintechs are helping this segment of the population to access credit thanks to lending models.

Crypto and Web 3

The crypto industry has grown rapidly within Southeast Asia, a large part of the companies within the crypto market are part of the fintech market, from exchanges to wallets to operate with cryptocurrencies.

Pavel Zavadskii, founder of Biqutex, added “Cryptocurrencies are definitely one of the fastest growing methods of paying for goods and services in Asia, mainly due to low transaction fees. Also, one of the success factors is the absence of unnecessary regulatory barriers and, accordingly, the opportunity for any business to quickly start accepting payments in crypto”.

Challenges for the SEA technology market

Technology companies have shown rapid growth over the last few years, however, in the first few months of 2024, they have faced some challenges.

One of the main challenges that the technological ecosystem has faced in the Asian region has been funding.

Crunchbase reported that funding for startups globally in the first three months of 2024 reached 60 billion dollars, one of the lowest amounts recorded since 2018.

Likewise, funding within the technology market in the SEA region has shown a downward trend, except for the particular case of companies within the market segment of artificial intelligence.

Claudio Cossio, Co-Founder of Meta Pool added, ‘Fragmentation is a key challenge for Fintech platforms in Asia and localization will be key to unlocking user engagement through the form of local promotions, access to credit lines, and integrations with established digital platforms such as WeChat and Kakao.’

According to The Business Times, start-up funding has declined 40% in comparison to the first quarter of 2023, reaching US$1.36 billion.A clear example of the tough situation the market is facing has been the massive layoffs carried out by companies such as Google, Tesla, and Amazon, among others.

The future of the tech market in SE Asia undoubtedly looks bright however it will need an overhaul in policies by nations in the region to attract investors.

Read More: How is the tech market evolving in the SEA region?

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.