Lido Staked Ether has surpassed XRP to become the sixth-largest cryptocurrency, with a market cap of over $31 billion.

Lido Staked Ether’s (stETH) bullish market is largely attributed to Ethereum’s significant gains this month, as the second-largest cryptocurrency reached $3,200 today and a 40% surge for the token in February alone.

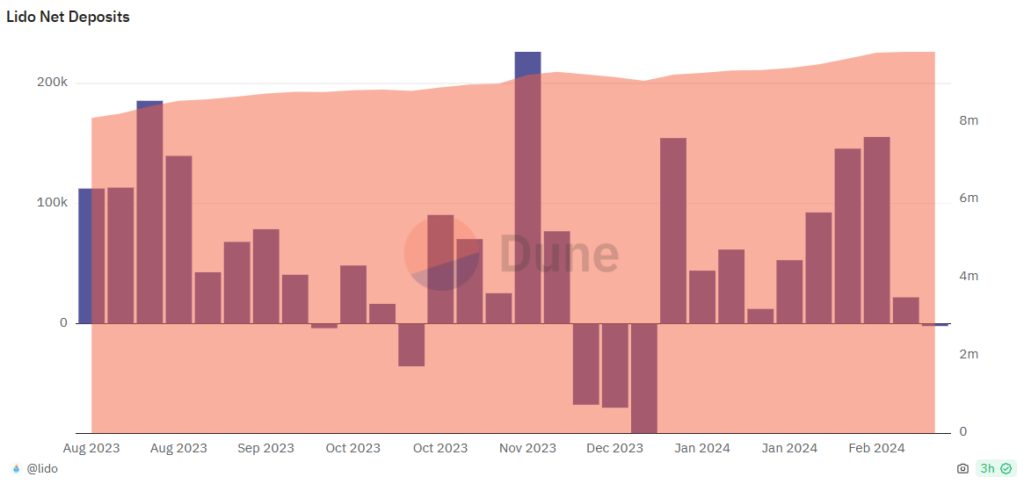

Dune analytics data shows that Ether deposits on Lido are nearing 10 million ETH, as the protocol hasn’t seen any net outflows since Dec. 19th. Currently, Lido Staked Ether accounts for 35% of all EH deposits on EigenLayer, one of the leading platforms that provide access to the Ethereum staked capital.

Lido Staked Ether represents a tokenized version of staked Ethereum in the Ethereum 2.0 Beacon Chain, facilitated by the Lido decentralized finance (defi) protocol. Lido enables users to stake their Ethereum without locking the assets or maintaining staking infrastructure, thereby addressing some of the key limitations associated with the Ethereum 2.0 staking mechanism.

At the same time, XRP is underperforming the market rally, losing nearly 2.5% in a week. Despite Bitcoin, Ethereum, and Solana recording notable gains today, XRP’s price has only seen a 0.5% increase.

XRP traders are showing a rather cautious sentiment in the market, as the ongoing battle with the SEC is still far from over. If the ruling favors the SEC, it could see XRP paying $2.64 billion in penalties, making 2024 the most profitable financial year for the commission.

Despite XRP’s disappointing performance this year, whales have invested $40 million in XRP over the last 10 days. This could suggest a potential buying the dip for the altcoin, which could eventually push XRP to break beyond its resistance level at $0.58 in March.

Read More: Lido Staked Ether takes over XRP in market cap as Ethereum reached $3.2k

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.