Key Takeaways

- TVL and fees in ETH are the best predictors of short-term token price movements.

- On-chain metrics outperform social sentiment in forecasting crypto price changes.

Share this article

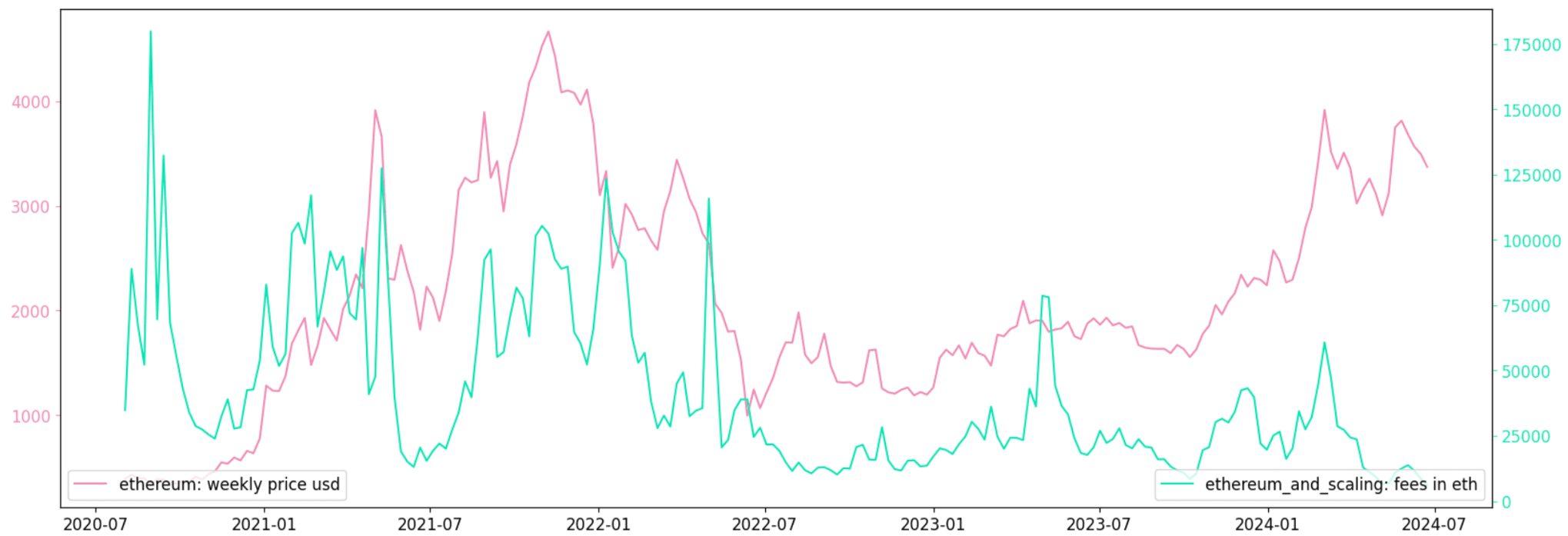

Nansen and Bitget Research have released a report analyzing on-chain metrics as predictors of crypto token prices. Key findings suggest that on-chain activity, particularly total value locked (TVL) and fees in Ethereum (ETH), are better predictors of short-term price movements than social sentiment.

The report found significant links between governance tokens and chain metrics for the Ethereum ecosystem and some other networks. Statistical tests revealed that TVL in ETH and fees in ETH form the best model for contemporary changes in governance prices.

The study examined transaction volume, new wallet creation, fees, and Total Value Locked (TVL) across 12 blockchains: Arbitrum, Base, Celo, Linea, Polygon, Optimism, Avalanche, Binance Smart Chain (BSC), Fantom, Ronin, Solana, and Tron.

“Our collaboration with Bitget is a two-pronged approach to token evaluation. For promising early-stage tokens, Bitget focuses on community strength, security, and innovation. Their recent product launches like PoolX and Premarket have facilitated the discovery of over 100 new tokens since April,” said Aurelie Barthere, Research Analyst at Nansen.

For predicting price returns one week in advance, both TVL in ETH and fees in ETH showed significance as individual factors. Higher fees and TVL tend to be associated with higher subsequent returns.

Notably, the study employed Fama-MacBeth regressions to estimate risk premia associated with token price returns. This is a widely used metric by financial practitioners to estimate the risk premia associated with equity market returns.

“As for predicting price returns, one week in advance, ‘TVL in ETH’ is a significant risk premium in a one-factor model and so is the metric ‘Fees in ETH’. Both have positive risk premia or coefficients, meaning that higher fees and higher TVL tend to be associated with higher subsequent returns,” highlighted the analysts.

Results were more significant when testing chains separately rather than aggregating Ethereum and layer-2 (L2) chains.

Share this article

Read More: Blockchain TVL and ETH fees are top indicators for predicting token price surges, data

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. coinzoop.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.