Onchain Highlights

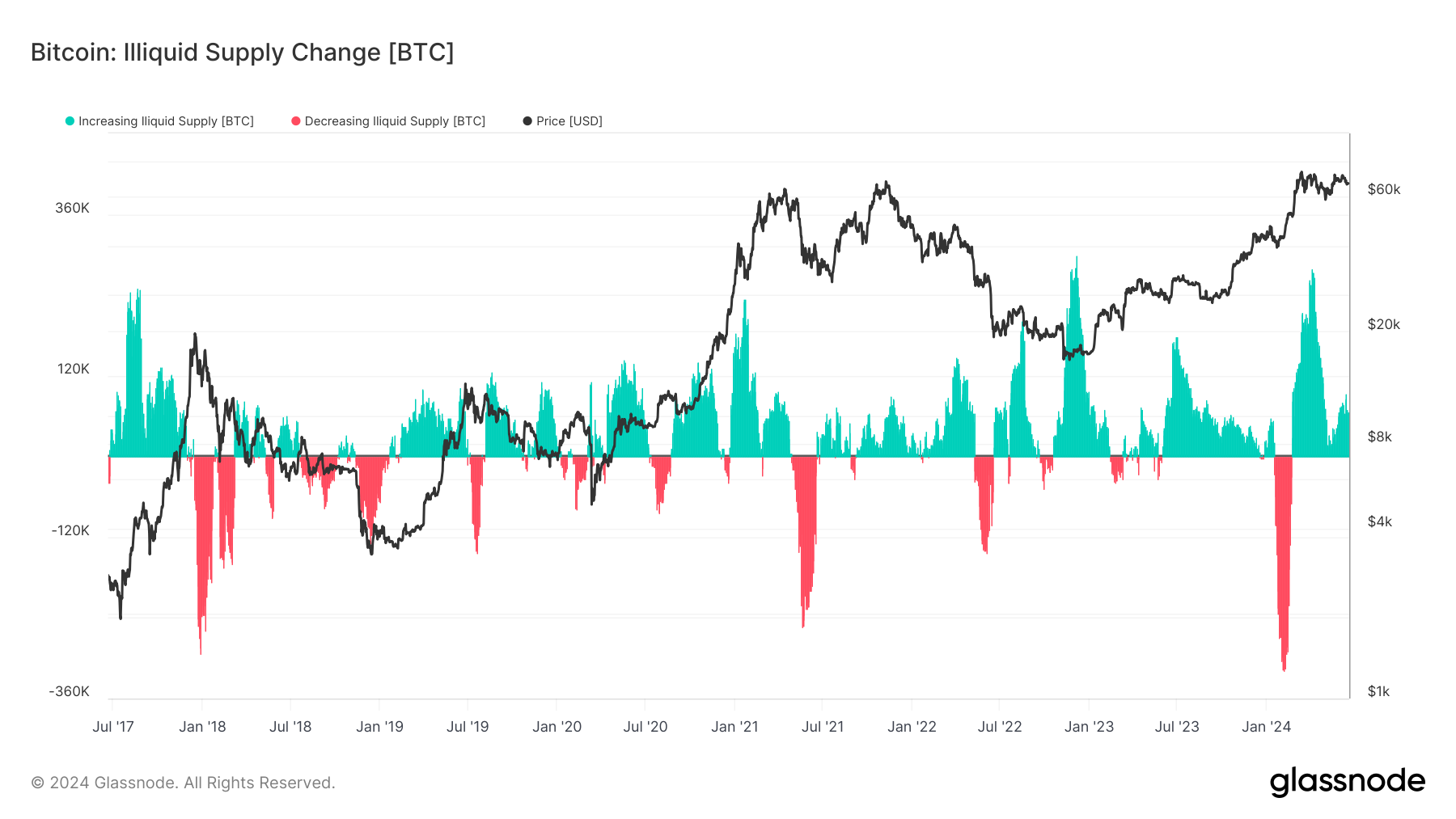

DEFINITION: Bitcoin Illiquid Supply Change is the monthly (30d) net change of supply held by illiquid entities.

Bitcoin’s illiquid supply may be at a critical juncture, indicating substantial market changes. Recent data from Glassnode reveals a renewed increase in the illiquid supply of Bitcoin since May, highlighting a strong trend toward self-custody among investors. This shift suggests a growing preference for long-term holding over active trading.

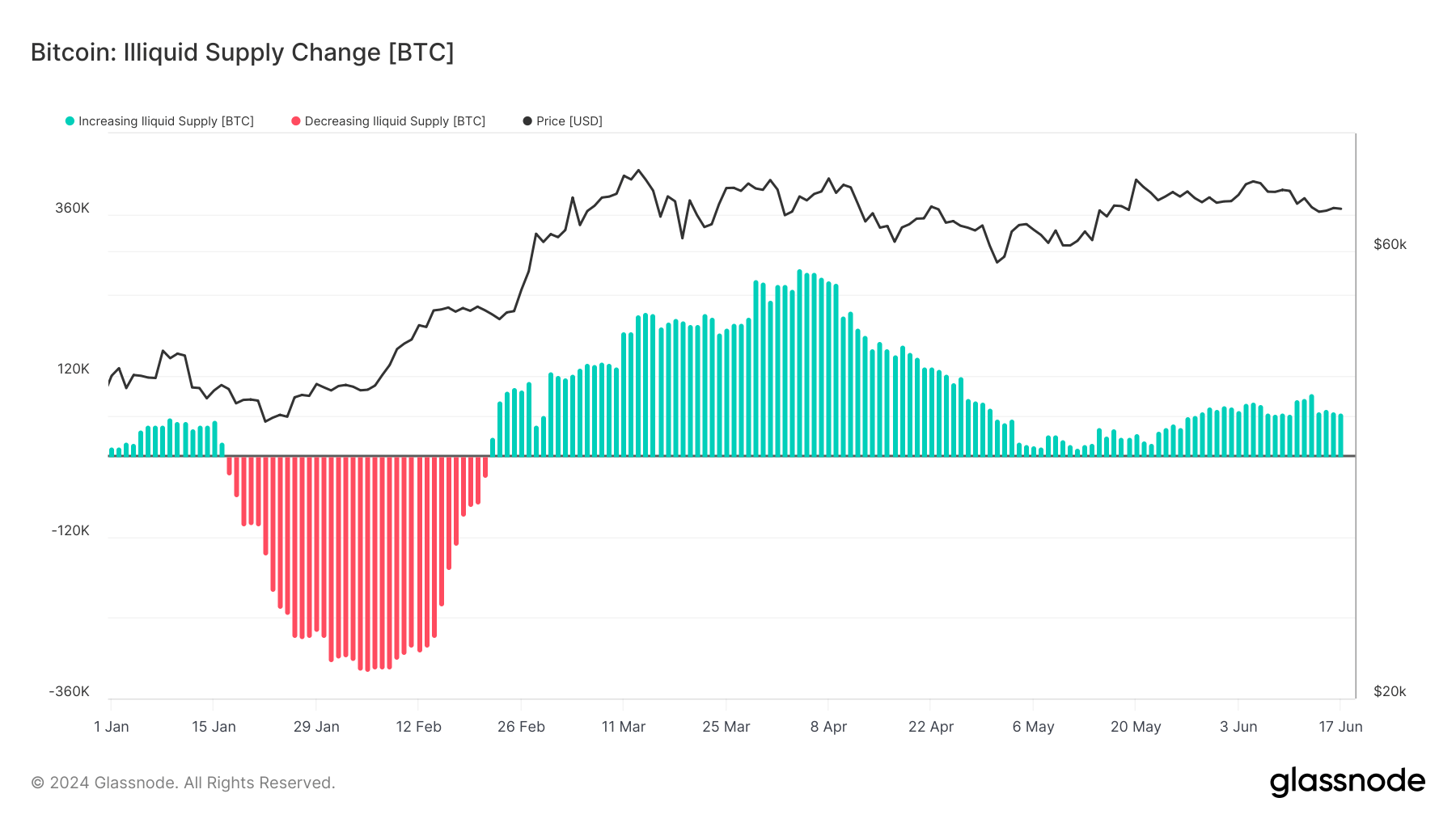

The illiquid supply of Bitcoin, representing coins moved out of exchanges into non-custodial wallets, has seen substantial fluctuations in 2024. These changes often correlate with broader market forces and investor sentiment. This trend reflects a deeper understanding among investors of the importance of secure storage, especially following recent market turmoil and high-profile exchange failures.

Moreover, CryptoSlate noted that Bitcoin’s illiquid supply hit a ten-year high in December 2023, showcasing strong investor conviction. This increase in illiquid supply typically coincides with upward price movements, suggesting that as more Bitcoin is held in long-term storage, the available supply for trading decreases, potentially driving prices higher.

The illiquid supply continued to increase throughout 2024, starting in mid-February. While the rate of change decreased in May, it has again begun to rise.

Overall, the trend towards increased illiquid supply spotlights growing confidence in Bitcoin’s long-term value and investors’ strategic shift toward minimizing exposure to market volatility.

Read More: Long-term Bitcoin holding trends push illiquid supply higher

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. coinzoop.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.